A Complete Guide for First-Time Homebuyers

Buying your first home is exciting but it can also feel overwhelming! Between financing, home searches, inspections, and closing paperwork, there’s a lot to navigate. The good news? With the right preparation and guidance from a professional, the process can be smooth and rewarding! If you’re a first-time home buyer, you will want to read this. This guide will walk you through step-by-step what to expect and how to get started with confidence. Step 1: Understand What You Can Afford Before you begin scrolling through listings on Zillow or Realtor.com late at night, picturing yourself in your dream home pause and determine your budget first. Your affordability depends on: Income Monthly debts Credit score Down payment amount Current interest rates Most lenders recommend keeping your monthly housing payment below 28–30% of your gross monthly income. Pro Tip: Use a mortgage calculator to estimate payments but talk to your lender for accurate numbers specific to your market. Step 2: Get Pre-Approved for a Mortgage Pre-approval is one of the most important steps in the buying process. A pre-approval: Shows sellers you’re serious Gives you a clear price range when searching for homes Strengthens your offer in competitive markets In a competitive market, it’s important to understand that many sellers won’t even consider an offer without a pre-approval letter. Step 3: Explore First-Time Buyer Programs Did you know there are special programs available to first-time homebuyers? You may qualify for: Low down payment loans (FHA, VA, USDA) Down payment assistance programs First-time home buyer grants State or local housing incentives Always check with your state/city, as there may be local programs specifically designed to help new buyers like you enter the market. Step 4: Start Your Home Search Now comes the fun part, house hunting! When searching for homes in your city, consider: Neighborhood and commute School districts (even if you don’t have children, school district impacts resale value) Property taxes HOA fees Future development in the area Make a list of: Must-haves (location, number of bedrooms/bathrooms, budget cap) Nice-to-haves (pool, large yard, updated kitchen) Try to stay flexible and realistic. No home is 100% perfect but the right one should check off most of your important boxes. Step 5: Make a Competitive Offer Once you find the right home, your agent will help you submit an offer. Buckle up! Your offer will include: Purchase price Earnest money deposit Contingencies (inspection, appraisal, financing) Estimated closing date In a competitive market, you may need a strong offer strategy to stand out. Step 6: Inspection and Appraisal After your offer is accepted, the home enters escrow. Home Inspection A professional inspector checks the property for structural, mechanical, and safety issues. If concerns arise, you may negotiate repairs or credits. Appraisal Your lender orders an appraisal to confirm the home’s value matches the purchase price. If the appraisal comes in low, your agent will guide you through options such as renegotiation or adjusting your financing. Step 7: Closing on Your First Home Closing typically takes 30–45 days from accepted offer to final signatures. Congratulations, you did it! At closing, you’ll: Sign loan documents Pay closing costs Receive the keys Closing costs usually range from 2–5% of the purchase price and may include lender fees, title insurance, and escrow fees. Common First-Time Buyer Mistakes to Avoid Even smart buyers can make avoidable mistakes but don’t be caught in one! Here are a few to watch for: Skipping pre-approvalThis can delay your purchase or weaken your offer. Draining your savingsLeave room for moving costs, furniture, and emergency repairs. Making large purchases before closingAvoid new credit cards, car loans, or big purchases, they can affect your loan approval. Ignoring resale valueThink long-term. Even your first home is also an investment. Is Now a Good Time to Buy? Ah… the question we’re asked more times than we can count. While market conditions may shift, the “right time” often depends more on your financial readiness than timing the market perfectly. If you: Have stable income Plan to stay in the home for several years Are financially prepared It may be the right time for you! A local real estate professional like me can help you understand inventory levels, pricing trends, and negotiation strategies specific to your area. Ready to Buy Your First Home? Buying your first home doesn’t have to be stressful. With the right guidance and a clear plan, you can move forward confidently. If you’re thinking about purchasing your first home, let’s talk. I’ll walk you through every step; from pre-approval to closing day and make sure you feel informed and empowered throughout the process. Contact us today to schedule a complimentary first-time buyer consultation. When you’re ready to get started with the process of selling or buying, get in touch with the team at Franklin Investment Realty! – Brianna Roth

Refresh and Resell: Practical Ways to Make Your Older Home Shine for Modern Buyers

Before After Selling an older home doesn’t mean settling for a dated look. With thoughtful updates and a few strategic improvements, you can create a modern, inviting atmosphere that connects with today’s buyers while celebrating your home’s character. Key Takeaways Before You Start ● Update key rooms like kitchens and bathrooms for maximum impact. ● Refresh curb appeal with clean lines and natural tones. ● Upgrade lighting, fixtures, and systems for a modern touch. ● Focus on efficiency; smart thermostats and insulation win big. ● Present the home as clean, bright, and easy to personalize. Reimagining First Impressions Curb appeal matters more than ever. Fresh exterior paint, neat landscaping, and modern house numbers can dramatically change how buyers feel before they even step inside. Simplify your home’s exterior with less ornate trim, more subtle contrasts, and well-placed lighting. These quick changes make a lasting impression without breaking the budget. The Hidden Value in Efficiency Many older homes lose value not because of aesthetics but because of energy inefficiency. Buyers today are savvy, they ask about heating costs, insulation, and airflow. Upgrading these unseen systems quietly boosts value and comfort while showing you’ve cared for the home. Smart Upgrades to Improve Efficiency Here are simple yet effective improvements that modern buyers appreciate: ● Replace traditional bulbs with LEDs throughout the home. ● Add or improve attic and wall insulation to stabilize temperature. ● Install programmable thermostats for energy savings. ● Seal around windows and doors to eliminate drafts. ● Replace older appliances with high-efficiency models. These subtle shifts make your home feel modern even before buyers notice the design details. Update with Quality Plumbing Features Outdated plumbing can quietly turn off potential buyers—even when the rest of the home shines. Swapping in new fixtures isn’t just about aesthetics; it’s about showing your home functions well and won’t come with hidden repair surprises. Whether you’re updating a faucet or rethinking a full bathroom setup, today’s buyers want reassurance that the water runs clean, the pressure is reliable, and the systems behind the walls are sound. If you’re ready to start, check out the available plumbing supply options that suit a range of budgets and home styles. A few smart upgrades can signal to buyers that your home isn’t just charming—it’s dependable. Declutter, Refresh, and Rebalance When preparing an older home for showings, the goal is simplicity with warmth. Remove clutter, but leave enough personality for buyers to imagine themselves there. Balance nostalgia with modern minimalism; keep meaningful elements, but present them cleanly. Home Prep Checklist for Interiors Before open houses or photography, walk through with this quick guide: Remove dark or heavy drapes to let in natural light. Repaint walls in neutral, warm tones like white, beige, or greige. Replace worn carpets with lighter rugs or polished flooring. Simplify wall art to highlight space and light. Use plants or subtle décor to add freshness without clutter. These easy steps make even an older layout feel open, bright, and inviting. Small Details That Make a Big Difference A few targeted updates can transform the feel of your entire home. Replacing outdated cabinet hardware, installing modern light fixtures, or refinishing original hardwood floors instantly boosts perceived value. Upgrade Type Buyer Perception Boost Typical ROI New kitchen hardware “Feels fresh and move-in ready” 70–80% Refinished hardwood floors “Premium, well-cared-for space” 90% Fresh exterior paint “Neat and well-maintained” 60–70% Energy-efficient windows “Smart and sustainable” 75% Updated lighting “Bright and contemporary” 60% FAQ Here are a few frequent questions homeowners ask before putting their property on the market. Should I renovate completely before selling?Not necessarily. Target visible upgrades with high visual and emotional impact, especially kitchens, baths, and lighting. Are original features still valuable?Absolutely. Restored woodwork or vintage tile adds character that buyers can’t find in new builds. Preserve, don’t replace, when possible. Do small upgrades really influence offers?Yes. Even minor cosmetic updates signal to buyers that the home is well cared for and ready to live in. Wrapping It All Up Modern buyers appreciate homes that blend old-world character with everyday comfort. With targeted updates, efficient systems, and thoughtful presentation, you can make your older home feel refreshed without losing its charm. By focusing on modern efficiency and timeless details, your property won’t just attract interest, it will stand out as a move-in-ready gem that bridges past and present beautifully. When you’re ready to get started with the process of selling or buying, get in touch with the team at Franklin Investment Realty! – Shirley Martin

How Homeowners with Low-Interest Mortgages Can Fight Against An Uncertain Future

If you were lucky enough to secure a mortgage when interest rates were at rock-bottom levels, you may have felt like you won the financial lottery. A 30-year fixed loan at 3% or less meant affordable monthly payments, long-term stability, and the flexibility to build wealth through homeownership. But now, as mortgage rates have more than doubled, that once-celebrated deal has turned into a financial anchor. Fewer homes are being listed, buyers are struggling with affordability, and the real estate landscape has fundamentally shifted. But while the challenges are real, so are the opportunities. If you feel financially trapped in your home, there are ways to navigate these market conditions—without making costly mistakes. Why Higher Borrowing Costs Have Frozen the Market At the heart of the issue is the “lock-in effect.” When homeowners hold mortgages with rates far below current market levels, the financial incentive to sell and buy again disappears. Imagine trading a 3% mortgage for one at 7%—your monthly payment could skyrocket, even if you’re buying a similar home. This has led to a historic drop in housing inventory, making it harder for buyers to find properties and reducing overall sales activity. Many homeowners who would have normally moved by now—whether upgrading, downsizing, or relocating—are simply staying put. Tapping Home Equity Without Selling If moving isn’t an option but you need cash for renovations, debt consolidation, or other financial needs, your home’s equity can be a powerful tool. Home equity loans and home equity lines of credit (HELOCs) allow you to borrow against the value of your home, often at lower interest rates than personal loans or credit cards. While borrowing costs have risen, they are still far lower than what you’d face with a new mortgage. If you’re looking to make your current home work for your evolving needs, using home equity to fund a renovation or expansion may be a smart alternative to selling. Turning Your Home Into an Investment Property For those who want to move but can’t stomach today’s high mortgage rates, converting your current home into a rental property might be worth considering. With low supply pushing up rents in many markets, you could generate passive income while securing a new home under different financial terms. This strategy works best if your low mortgage rate allows you to cover your loan payments with rental income, or if you’re in a high-demand rental market. However, being a landlord comes with responsibilities, so it’s important to factor in management costs, taxes, and potential vacancies before making the leap. Creative Financing: Alternative Ways to Buy Your Next Home If selling and buying a new home is unavoidable, consider alternative financing options to minimize the sting of higher interest rates. Adjustable-rate mortgages (ARMs), which offer lower initial rates that adjust after a set period, could provide short-term relief—especially if you expect rates to decline in the coming years. Some lenders and homebuilders are also offering rate buydowns, where they reduce the interest rate on your loan for the first few years to help with affordability. While these options require careful planning, they can be effective for buyers who anticipate future financial flexibility. Waiting Out the Market: How Long Until Conditions Improve? For homeowners willing to be patient, market conditions may eventually shift in their favor. If inflation cools and the Federal Reserve begins to ease interest rates, mortgage rates could decline in the coming years, making moving more financially viable. Additionally, a slowing housing market may lead to price adjustments, potentially creating better opportunities for buyers down the line. In the meantime, improving your financial position—paying down debt, boosting your savings, and strengthening your credit score—can put you in the best possible position for when the market becomes more favorable. Earn Some Extra Cash With rising costs putting pressure on household budgets, starting a small business can be a smart way to generate additional income and build long-term financial security. Whether it’s a side hustle or a full-time venture, launching a business requires careful planning—developing a solid idea, researching your market, and handling the legal essentials. One of the best steps you can take is forming a Limited Liability Company (LLC), which protects your personal assets if your business runs into legal or financial trouble. While hiring a lawyer to handle the paperwork can be expensive, you can register your Pennsylvania LLC through a highly rated formation service to streamline the process at a fraction of the cost. By keeping startup expenses low and structuring your business properly, you set yourself up for success without unnecessary financial strain. Being locked into a low mortgage rate in a high-rate environment can feel frustrating, but it’s also a reminder of the financial advantage you hold.. Until market conditions shift, the best approach is to stay informed, plan strategically, and make the most of the home you’re in. When you’re ready to get started with the process of selling or buying, get in touch with the team at Franklin Investment Realty! – Shirley Martin

How to Find the Perfect Home for Your Golden Years: What to Look For

As we age, our wants and needs change. This is especially true when it comes to finding the perfect home in Philadelphia. It can be difficult to find a house that meets all of your needs, but with a few key features in mind, you can make sure you get the home of your dreams. From Franklin Investment Realty, here are a few things aging homebuyers should look for when searching for the best fit. Investigate the Local Housing Market Before buying a new home, Realty Biz News notes that it is important to research the area’s housing market. This helps you understand the range of prices and other factors so that you can find a house in Philadelphia that fits your needs and budget. Additionally, it allows you to narrow down your search quickly and efficiently so that you can make an informed decision about which house to buy. Single-Story House A single-level home is an ideal choice for seniors due to the lack of stairs which could be a hazard, as well as its easy access and mobility. No need to worry about navigating steps or maneuvering tight corners with furniture. With a single-level home, aging homeowners can enjoy the comforts of their own space in safety and ease. Broad Halls and Doors Wide doors and halls are important features to look out for in an aging homebuyer’s dream house. This allows more space when moving furniture or larger items into the house without having to worry about them getting stuck in tight spaces or doorways. Plus, as Mobility Medical Supply points out, wider doorways give more room when accommodating wheelchairs or walkers if needed. Turning Knobs and Lever Handles Lever handles and knobs are a great option for those concerned with ease of use. They are much easier to grip than traditional round knobs and require less strength in the hand – making them ideal for those whose hands may weaken over time due to age or arthritis. Lever handles also offer better accessibility as they are easier to open and close. Aspects of Automation Automation features like automatic lighting and voice-controlled appliances make life easier as we age by reducing the manual labor needed to carry out everyday tasks. It also provides an added layer of safety by cutting down on trips up and down stairs or outside into dark areas. Additionally, automation features provide convenience since they are easy to use and operate with minimal effort. Non-Slip Surfaces Non-slip flooring is an essential component of any aging homeowner’s dream house. Slippery surfaces can lead to falls with the potential for serious injury or even death, particularly depending on age and health status. Non-slip materials such as vinyl, laminate, cork, and rubber provide extra traction and reduce the risk of slips and falls in one’s home environment. Skilled Care Facility Options It’s also important to look into the area’s skilled nursing facilities should you need 24/7 care. In that case, you’ll want to choose a new living arrangement near potential communities, or even moving into a facility that meets your needs. You’ll find nearly 50 such facilities in Philadelphia. Finding the perfect Philadelphia home isn’t easy, but with a little research and planning it doesn’t have to be overwhelming. Research local housing markets so you know what kind of prices and amenities are available, and opt for single-level homes. Also consider your assisted living options should there be a need now or in the future. These tips will help you find and adapt a home to suit your needs as you age. – Shirley Martin

What Is My Home Worth?

Check out this tool to understand the current value of your home. As well as tracking your equity as your time as a homeowner grows. Thinking about selling or refinancing? This will allow you to see current interest rates and understand current market activity. Interested in buying a shore house, mountain house, second home, or investment property? Check your equity position to see what financing tools you can take advantage of. – Matt Scannapieco

Philadelphia Neighborhoods You Want To Live In

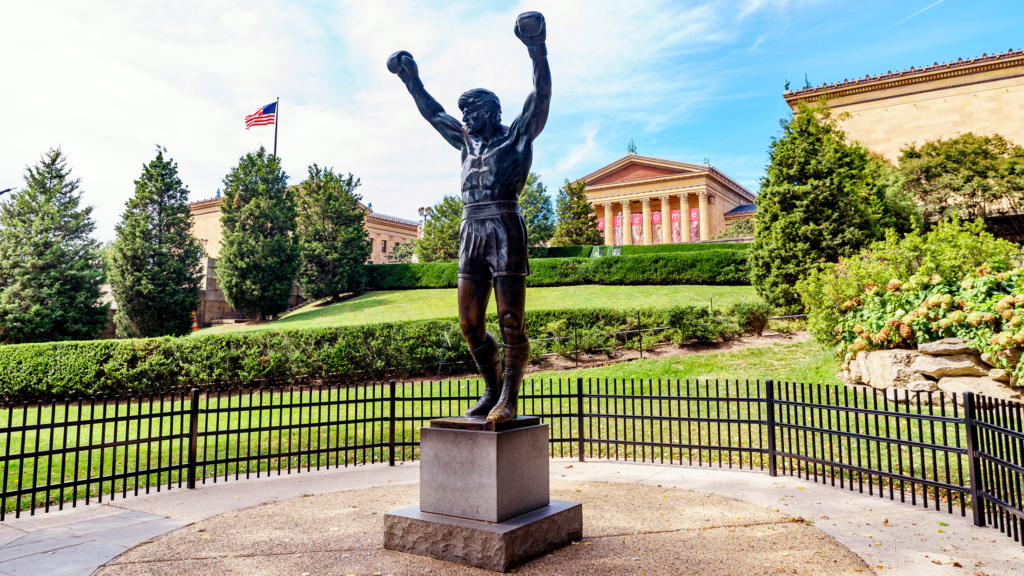

The city of Brotherly Love has a rich and vibrant history. The Liberty Bell is here, along with the steps Sylvester Stallone made famous in Rocky. Philadelphia is a thriving city with affordable living costs, and this includes home prices. When you’re ready to start house hunting, one of the first steps is to pick a neighborhood. Philadelphia’s Best Neighborhoods for Homebuyers From Mt Airy to Wissahickon Walk and Brewerytown, homebuyers will find the perfect neighborhood that fits their lifestyle. Mt Airy Situated between Chestnut Hill and Germantown, Mt Airy is part of a trio of neighborhoods on Philly’s northwest side. It’s a diverse, multi-culture neighborhood that’s drawing urbanites in. Mt Airy is an established neighborhood that gets its name from the original summer resort built by William Allen after the American Revolution. The west side boasts spacious million-dollar homes on tree-lined streets, some complete with a dedicated entertainment room perfect for installing you’re A/V receiver and other audio components. Homes on the east side are more affordably priced, and you still get the same quiet, family-friendly vibe in the neighborhood. With shops, restaurants, and easy access to SEPTA bus and rail routes, you have everything you need within walking distance of your new home. Wissahickon Walk Bordering Wissahickon Valley Park and the Schuykill River, Wissahickon Walk is a neighborhood for nature lovers. It also boasts a low crime rate and plenty of activities for residents. Along with the 20-mile long Wissahickon Walking Trail, the neighborhood has a thriving nightlife with restaurants, bars, and clubs spotlighting local musicians on the weekends. Home styles vary from mid-century to more modern. It’s a well-established community that is continuing to grow. Most homes on the market are mid-sized and competitively priced. Along with free-standing homes, you can also find condominiums and townhomes. If you’re interested in a condo, Wissahickon Walk Condominium Complex is close to schools, public transportation, and everything else the neighborhood has to offer. Brewerytown Brewerytown is a northern Philadelphia neighborhood named for the nine breweries that called the area home. The breweries closed during the Prohibition Era, but the neighborhood is experiencing a revitalization. Beer gardens and craft breweries are moving back in, along with restaurants, shops, and new residents. It is an upcoming neighborhood, but home prices are still affordable. However, prices are increasing as the revitalization continues. Row homes line the streets, along with warehouses converted into lofts and luxury apartments. You can also find bargain prices on fixer-uppers. Along with the breweries and restaurants, the neighborhood is a short walk away from Fairmount Park. It’s the largest park in Philadelphia, and it’s also not far from the Philadelphia Zoo. Let Franklin Investment Realty Help You Located in Philadelphia, Franklin Investment Realty is familiar with every neighborhood in the city of Brotherly Love. Their expertise covers all types of dwellings, including condos and luxury homes. Whether you want a quiet, family-friendly neighborhood to call home or one with a vibrant nightlife, Matt Scannapieco and his team at Franklin Investment Realty will help you find the perfect home in a neighborhood you’ll love. – Karl Kennedy

Enlist the Help of These 14 Professionals to Build or Renovate Your Home

We often dream of an extensive renovation project for our home or think of building a house from the ground up but seldom act upon it. Most of us drop back to reality, thinking, “I wouldn’t even know where to start!” So, here’s the solution to your problem. If you would like to build or renovate your home, you will need to enlist the help of several professionals from the construction world. We have put together a comprehensive list of professionals involved in building a house for a hassle-free successful construction project from start to finish. Fourteen important partners work with you to build or renovate your home. Let’s take a look: Author Bio: Rahul Agarwal is the Co-founder & Chief Business Officer at Styldod, where he has taught a computer to do interior design! Styldod provides the most hassle-free & inexpensive virtual staging solutions for real estate agents so they can sell their listings faster, and for higher prices. Rahul was also a co-founder of Mebelkart. He’s your everyday IIT Kanpur nerd who pushes the boundaries with his innovative entrepreneurial stints and is also a sound startup investor & advisor.

Tips On How To Get Ready For An Open House

It’s almost time to start showing your home off to potential buyers. You’ve decided to sell, found a real estate agent, and come up with a fair asking price. All that’s left is to set the date for your open house, but is your home ready for the flood of visitors? Before your real estate agent starts advertising your open house there are a few things you want to do. Get Rid of the Clutter Start getting ready for your open house by removing all of the clutter. Take a walk through every room and declutter every surface. Along with desks, tables, and shelves, remove any stuff you have gathering dust on the windowsills. You want potential buyers to have a clear line of sight, so they can see the dimensions of the space. It’s one thing to know a room’s size from a floor plan and another to see it. What you don’t want to do is shove the clutter in a closet or junk drawer. Most home buyers want to look at the storage capacity. Having junk fall out of a closet is a good way to lose the sale. Don’t forget to pick up any kids’ toys and baby strollers as you’re cleaning up each room. Clean Your Home From Top to Bottom Depending on your budget and the size of your home, you may want to splurge and hire a cleaning staff. You can pick and choose what you want sparkling clean, and some home cleaning companies will even tackle your air vents. Areas you want to thoroughly clean are the kitchen, bedrooms, bathrooms, and living areas. Entryways also need a good cleaning, especially along baseboards where dirt and grime accumulate. Don’t forget about the laundry area and mudroom if your home has one. Windows, inside and out, also need cleaning. Multi-story homeowners may need to hire a professional window cleaner Walls and Flooring Take a good look at your walls and flooring. Are they a neutral color and in good condition? It is an added expense but redoing your walls and flooring will appeal to more buyers. Stick with neutral colors and forego accent walls and wallpaper. You also want to stay with neutrals if you are replacing worn-out carpeting. Neutral tones do not make a statement, but it lets potential buyers envision the space’s potential with their tastes in mind. Pack Up Family Photos and Personal Mementos You love looking at your photo displays, photos, and your children’s artwork. These items are what make the house your home. Personal items are also distracting to buyers. It’s hard for them to imagine their belongings in your personal space. A successful open house is when buyers can feel like they can make your house their home. Take a Look at Your Front Door Your landscaping is lush, and the yard is freshly mowed. Your home has curb appeal but does your front door welcome visitors? The front door is something homeowners often overlook. Unless your front door is badly damaged, chances are a fresh coat of paint will have it looking like new. It’s an inexpensive upgrade that increases the home’s curb appeal and makes visitors want to come inside. Final Words Getting ready for an open house is exciting, and it’s not hard to make it successful. Your goal is to present a clean home that potential buyers can see themselves living in. If you follow these tips, you can have a successful open house and hopefully find the right buyer for your home. – Karl Kennedy

Things to Know About Home Ownership Before You Move Into Assisted Living

Moving into assisted living is an uncertain time for many seniors. If you or someone you love is facing this difficult decision, there may be many questions about what to do with their current home as they enter this new life stage. Fortunately, there are options, and here are a few things to know about the most common, which are selling, renting, and keeping it in the family. Selling can help you cover the cost. According to Caring.com, the average cost of senior living around the Philadelphia area is about $3500 per month. This is on par with the national average, meaning that Philadelphia is a fairly affordable city in which to retire. But, that does not mean it’s cheap, and selling your home may be a necessity. If so, you can trust Franklin Investment Realty to help you get the most out of your home as quickly as possible. If you’re not sure how much you can get for your house, keep in mind that the Philadelphia housing market changes often. But, as of December 2021, the median sale price in Philadelphia hovered at around $255,000. So, if you have been in your home for many years, you likely have a large amount of equity to cover your assisted living care cost. You can rent for a monthly income. If you’re looking to earn a monthly income, you might also consider using your property as an investment/rental. In the Philadelphia area, a two-bedroom can rent from anywhere from about $900 a month up to nearly $2,800 a month. This might not be enough to cover the entire cost, but, if you have some money in savings it can help bridge the gap. Leasing your home does pose challenges, however, including continued maintenance costs and the potential for poor renters. You also must continue to pay taxes (likewise, you may have to pay taxes on profits if you sell). Something else to consider if you plan to handle property management on your own is how far away your assisted-living center is from the property. Make an estate plan if you want to leave the home to a specific family member. Another option that many homeowners choose is to keep the home, continue to make payments on it, and leave it to heirs upon their death. If this is the case, it’s important to create a legal estate plan, such as a will, trust, or transfer-on-death deed. According to Santaella Law Group, either of these is a viable option. Something to keep in mind here is that your heirs will be responsible for property taxes and any outstanding liens on the home, even if you have left it to multiple individuals. Another important point to consider when creating an estate plan is that you can change it prior to your death if your circumstances change. For example, you deed the property to another upon your death but then choose to sell the home instead. You can change your estate plan to remove the beneficiary on this property and outline exactly what you want done with your home sale proceeds. While you might be intimidated at the thought of moving into assisted living, you should know that you are in good company. Around 835,000 men and women currently live in assisted living throughout the United States. With this many moves each year, you’re sure to find a real estate agent or financial advisor that has experience in this arena to help you make a decision that’s best for you and your family. Remember, you have options. And, short of selling your home immediately, you can always change your mind later if your situation changes. Founded in 1992, Franklin Investment Realty has years of experience and can help you buy or sell the home of your dreams. – Rhonda Underhill GetWellderly.com

Renovating Your Floor? Consider these 5 Things First!

The flooring of your home plays a vital role in setting the tone for your interior. Whether it be a new home or renovation, flooring makes a significant impact on the overall design theme of any space. As the floor is the most exposed part of your interior and goes through regular wear and tear, the practicality and durability of the flooring material also has a crucial function. Such factors make selecting an appropriate flooring material a highly essential task. Consider These Things First! Before you get started with your floor renovation, here are a few things that you should keep in mind. 5 Simple Ways You Can Renovate Your Floors On A Budget Here are 5 material choices that you can use to enhance your home’s quality while remaining within the budget. It is imperative to choose the correct flooring for your space, considering the aesthetic, durability and cost of the flooring in mind. What works for one room may not work for another. Thus, it is best to complete your own research before investing in a flooring option, as you are going in for a long-.term investment. – Isha Tandon Isha has worked within the architecture and interior design industry as a flooring consultant expert – specializing in tiles, stones, and terrazzo. She has worked with Orientbell Limited, a leading tile manufacturer in India, as a product development manager in the design team and has recently joined the marketing team as their digital content expert. Her experience comes in handy in understanding the audience as she creates value-driven functional & informational content for the readers. She creates lifestyle pieces that focus on interior design products, trends, and processes. She loves to travel to historic places with rich architecture.